A Solution for Risk-Based Anti-Money Laundering Compliance

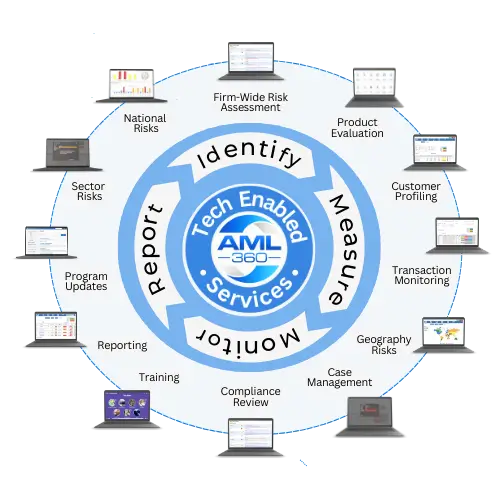

Anti-money laundering compliance efficiency should incorporate low operational costs. Compliance efficiency and low costs can be achieved when an anti-money laundering compliance framework operates with automated data processing. AML360™ simultaneously collates data, measures the data and reports on AML/CFT compliance outcomes. Gain compliance efficiency and affordability.

Option #1

Option #2

Option #3

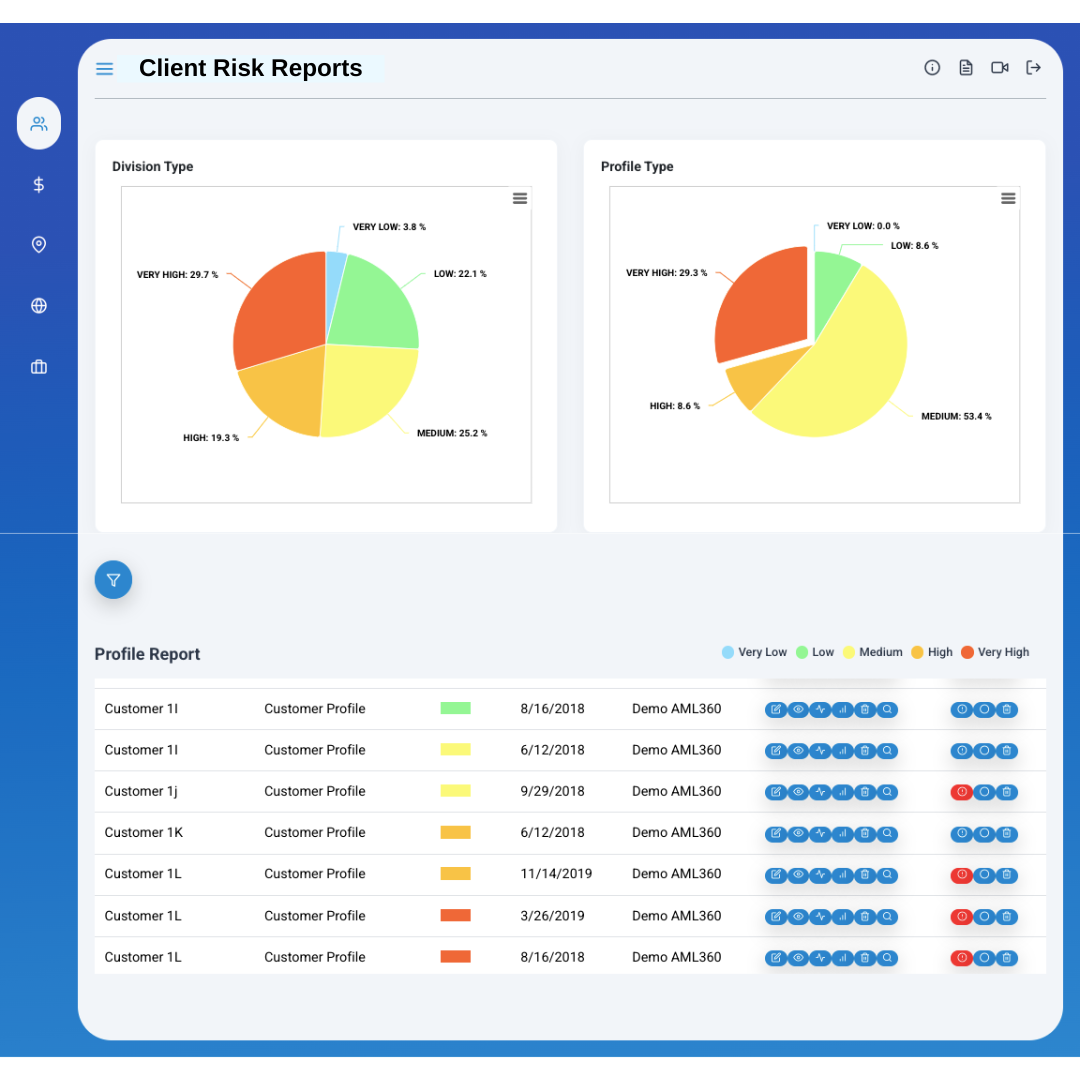

Get Customer Risk Rating Reports and protect the privacy of your customers. AML360™ uses a ‘Unique ID’ so only your business knows what customer the Unique ID pertains to. This meets obligations of the Privacy Act 2020 and ensures your business retains client confidentiality.

Compliance Forms

Click on your customised link to activate AML/CFT compliance modules. Automate work flows and risk-based reporting.

AML/CFT Register

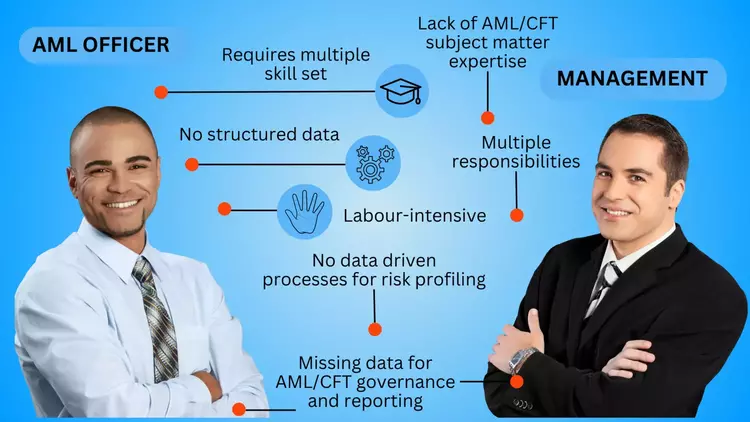

For businesses lacking internal subject matter expertise, structured AML/CFT compliance reporting does not get any easier.

Compliance Professional

Get third-party oversight services, including a customised AML/CFT Register for ongoing AML/CFT compliance assurance.

- Forms

- Cloud

- Pro

Option 1

Small Businesses

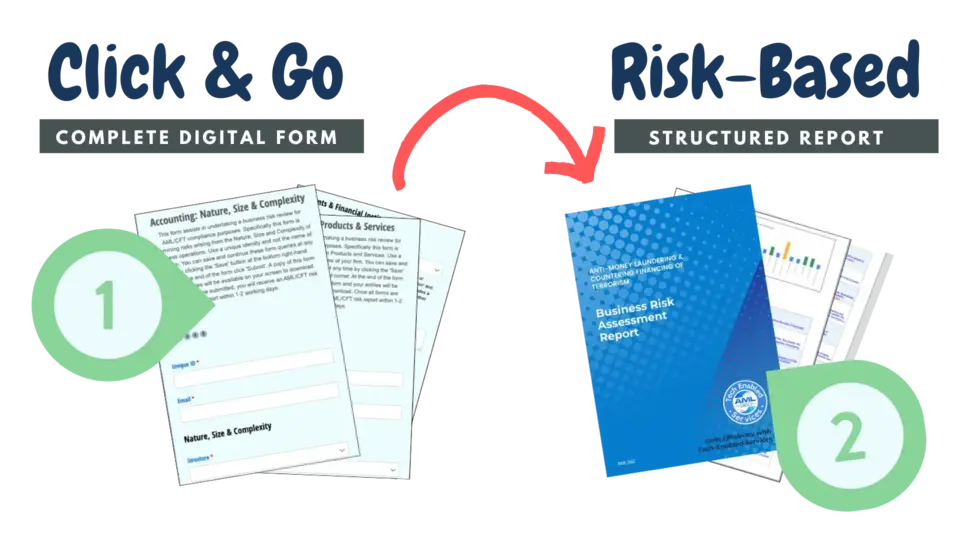

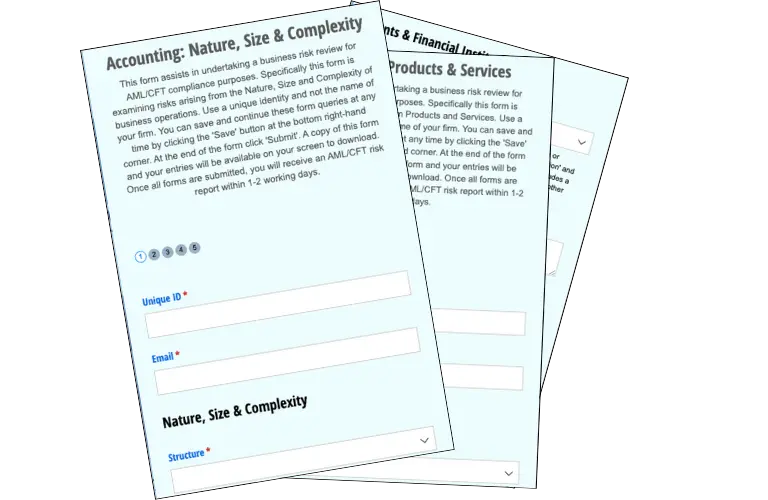

AML360™ provides your firm with digital forms that can be activated at anytime to complete AML/CFT compliance processes. Digital form solutions are available customised to your brand and business colours. The links can be embedded into AML/CFT programmes to represent procedures and controls.

This solution is most suitable for small businesses that are looking for automated processes and compliance expertise.

Digital forms can be used for AML/CFT business risk reports and updates, receiving customer risk ratings, client activity monitoring and internal compliance reviews.

Option 2

Medium Sized Businesses

Login to a secure Cloud platform at anytime and any place to execute AML/CFT compliance reporting.

Your AML360™ Cloud platform can manage every aspect of compliance reporting including business risks, customer risk ratings, activity monitoring, compliance reviews, case management, geography risks and more.

Compliance configurations can be set by your business or by our professionals.

This option ensures your business can demonstrate AML/CFT compliance 24/7.

Option 3

Large Sized Entities

If your business requires subject matter expertise, as well as implementation of AML/CFT compliance systems, AML/CFT Outsourcing may be the right choice.

This AML/CFT compliance option can reduce AML/CFT compliance costs greater than 50% - whilst ensuring ongoing compliance efficiency.

An AML/CFT compliance specialist is available Mon to Fri, 9am-5 pm. Your business also has 24/7 access to the AML360™ compliance platform. Log in at any time and check your compliance status.

Customer Risk Rating

Ongoing Monitoring

Don’t fall behind in AML/CFT ongoing monitoring and compliance reporting.

Internal Reviews

Easily administer an internal AML/CFT compliance review and check your AML/CFT status.

An Anti-Money LaunderingCompliance Framework that Automates Monitoring and Reporting

Reduce operational business costs by eliminating labour intensive processes. Gain compliance efficiency with automated data processes for risk analysis and reporting.

From 1 June 2025 businesses captured under anti-money laundering compliance laws must have client risk ratings in place. This applies for new clients and for ongoing monitoring purposes.

AML360™ uses unique IDs so your business retains client privacy. We easily implement your compliance strategy to meet regulatory expectation of risk-based profiling, monitoring and reporting.

Check our affordability and gain AML/CFT compliance efficiency.

Digitise Your Anti-Money LaunderingCompliance Programme

Work smarter and not harder by utilising AML/CFT regulatory technology. A solution is available to meet your needs and budget. Save time and money by effectively managing AML/CFT compliance obligations with AML360™.

Anti-Money Laundering Compliance & Risk-Based Reporting

AML360™ provides your business with digital forms to automate procedures and controls for anti-money laundering compliance. Activate the form links to receive professionally structured compliance reports for business risk assessments, client risk ratings, activity monitoring and ongoing internal reviews.

What are the Essentials of an Anti-Money Laundering Compliance Framework?

AML360™ is configured by anti-money laundering compliance professionals to automate risk profiling and reporting. Your firm has options of utilising digital forms with business brand colours and logo, then embedding these forms into your AML/CFT Programme. Click to activate AML/CFT risk-based processes and procedures. Alternatively your firm can operate a secure Cloud platform and have AML/CFT risk profiling, monitoring and reporting at your fingertips.

DIGITAL FORMS

Use your brand and customised digital form to complete business risk reports, client risk profiling, monitoring and more.

CLIENT RISKS

Use for managing higher risk customers, higher risk countries or internal reviews. Automated prompts and alerts.

RED FLAGS

The AML360™ platform brings AML/CFT compliance management and reporting into one digital framework.

AML SOFTWARE

This affordable AML Software Solution enables easy navigation and informed AML/CFT reporting.

Automate Anti-Money Laundering Compliance

Governance and Anti-Money Laundering Compliance Reporting

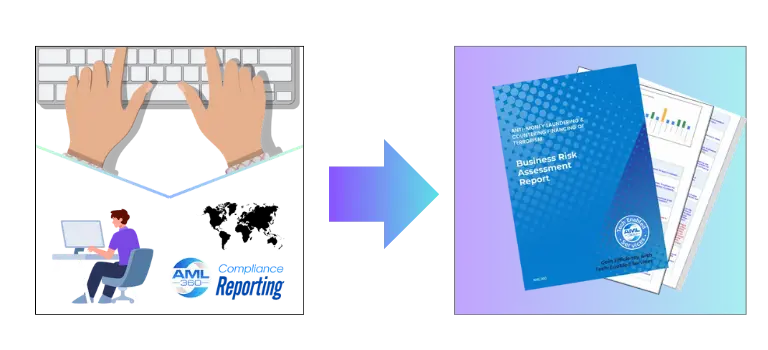

Regulatory expectation is increasing from AML/CFT Supervisors. These increased expectations require business owners, Board members and risk managers to be informed of AML/CFT compliance risks. AML360™ provides evidence-based policies, procedures and controls operated from a keyboard.

Anti-Money Laundering Compliance Reporting

Easily activate professional workflows by selecting a single or multiple AML/CFT compliance modules. Click to activate governance controls for anti-money laundering compliance obligations.

AML360™ seamlessly integrates Customer Risk Rating and Reporting into an AML/CFT compliance programme.

Anti-Money Laundering Compliance Software that Automates Monitoring and Reporting

If your firm has not yet experienced the benefits of regulatory technology, get in touch with AML360™ for a free trial. We have solutions for businesses to automate administrative functions of client risk profiling, activity monitoring, management reporting, case management, online training courses, geography risks and more. Add your AML/CFT identity verification provider to the AML360™ platform and manage every aspect of AML/CFT compliance with one login - anywhere, anytime.