Firm-Wide AML Risk Assessment

Streamline Your AML Risk Assessment

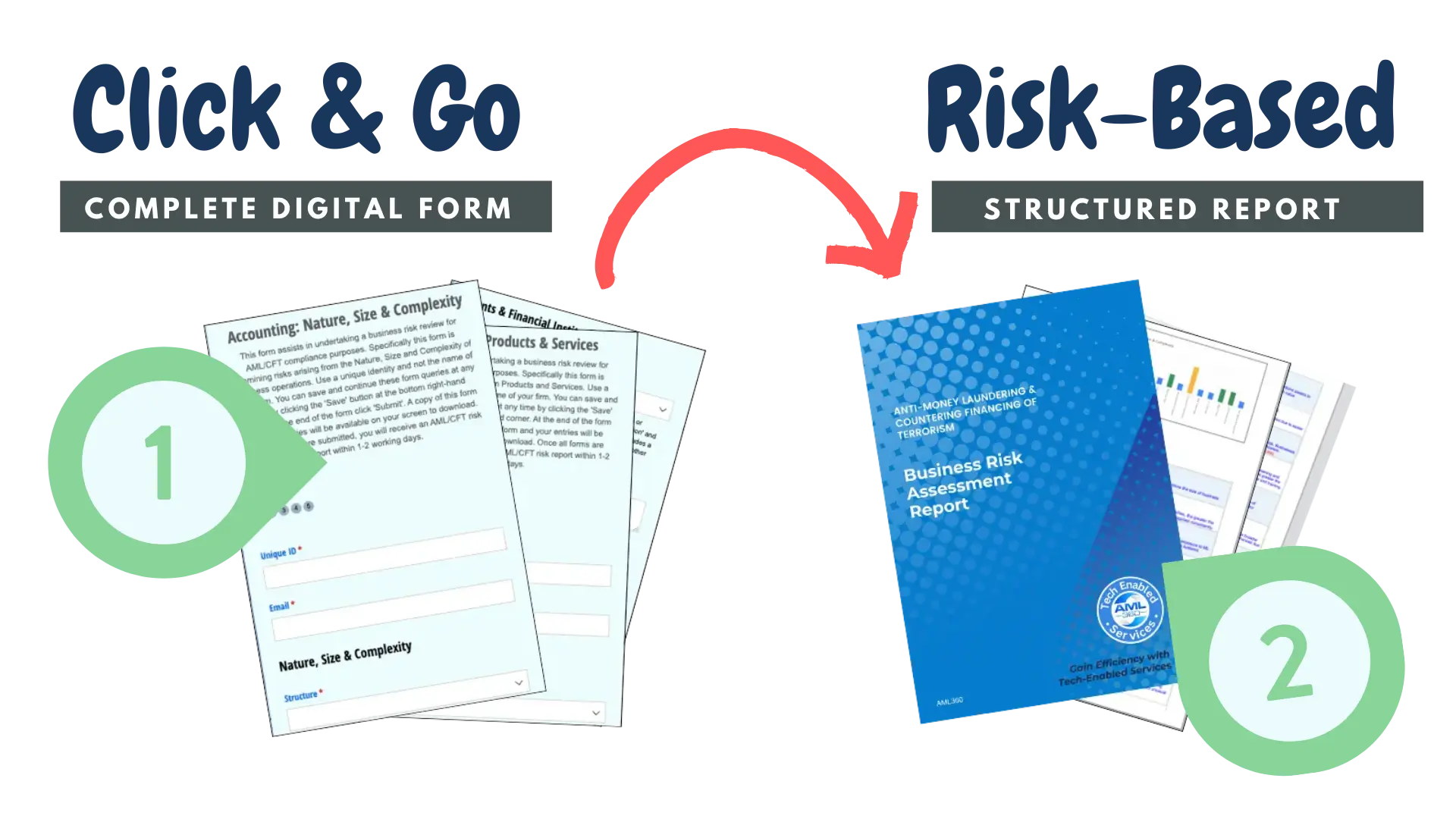

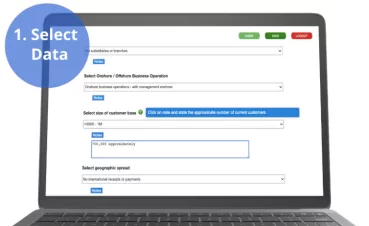

AML360™ provides affordable options to streamline the business AML risk assessment report. A risk-based methodology is applied and explained. Your business eliminates complexities and reduces costs with automated reporting. Select data on screen and submit for receipt of a comprehensive AML/CFT business risk report.

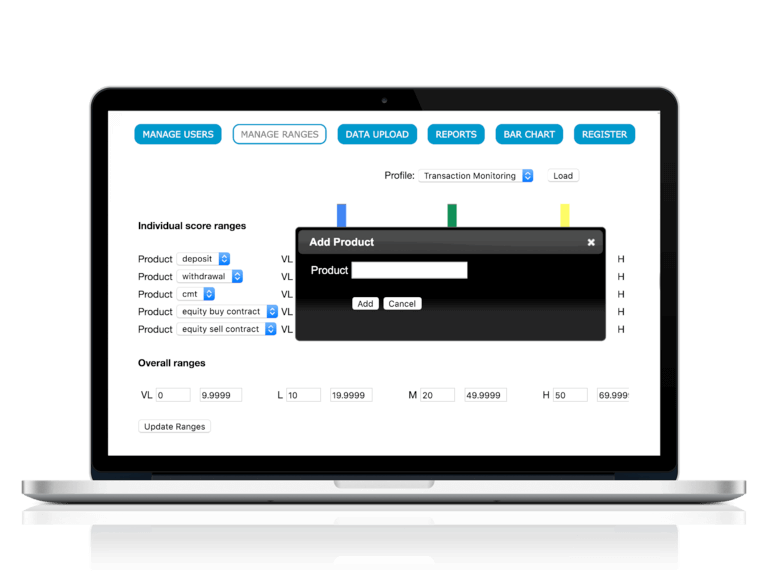

Data At Your Fingertips

AML Risk Assessment and Compliance Report

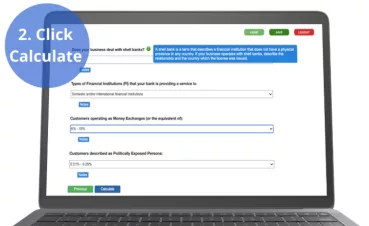

Don’t struggle with preparation and application of risk-based methodologies for AML/CFT risk assessments. Rely on AML360™ regulatory technology for risk-based profiling and reporting. Anti-Money Laundering Compliance Officers can streamline the AML firm-wide risk analysis and reporting with a ‘Click and Submit’ action.

Prompts and tips

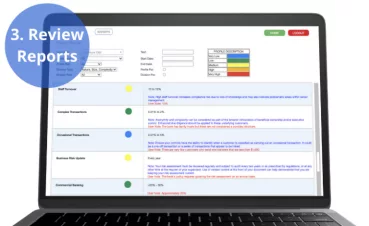

AML/CFT Risk Assessment: Step #1

Your risk assessment report provides tips and prompts for developing your programme. This ensures your AML/CFT risk programme is aligned to your AML/CFT risk assessment – a regulatory obligation.

Complete in your own time

AML RIsk Assessment: Step #2

You pick the time to complete your risk assessment and programme. If an interruption occurs, save your work and finish when it is more convenient.

Gain Knowledge

AML RIsk Assessment: Step #3

AML360 provides a full data report with commentary on why certain elements of your business have inherent high risk. We carefully explain these factors and provide guidance information for the development of your compliance programme.

The AML Risk Assessment Guides Policy, Procedures and Controls

Anti-Money Laundering Compliance Officers are required to develop and maintain an AML/CFT risk assessment methodology. The purpose is to ensure the inherent risks are identified and are adequately managed with AML/CFT policies, procedures and controls.

International standards recognise that the core drivers of facilitating money laundering and/or financing of terrorism across a business stem from :

- The nature, size and complexity of the business entity; and

- The client or customer types that the business seeks to attract; and

- The type of products and services that the business entity delivers to clients and/or customers; and

- The method of how products and services are delivered and how ongoing contact with customers is maintained; and

- Geographies dealt with; and

- The types of Business- To-Business (B2B) relationships established for business operations.

How To Risk Assess 'Nature, Size And Complexity'?

All businesses have unique characteristics. This contributes to the risk-based principles of anti-money laundering compliance laws by placing responsibility on owners and managers to assess their ML/FT risks, report on the outcome and maintain ongoing reporting.

Matters to consider for ‘Nature, Size and Complexity’ include (a) the number of staff, (b) the number of customers, (c) the volume of transactions, (d) how many branches exist, (e) countries of business reach, (f) how many staff dedicated to AML/CFT compliance, reporting and (g) governance structure for AML/CFT oversight.

What Are Examples of Higher Risk Clients in AML/CFT Compliance?

The client exposes a business to the greatest risk of unwittingly facilitating money laundering or financing of terrorism. This can be explained by realising if the client has no intention to commit a financial crime, then the likelihood of such activity occurring is also unlikely. However, some clients may operate through third parties or with joint accounts. These type of client relationships increase risk.

AML/CFT Client Risk Ratings are necessary in order to Know Your Customer risk profile.

What Are The Money Laundering Risks of Products and Services?

Certain characteristics of products and services that a business distributes can be attractive to those who engage in money laundering or financing of terrorism.

Inherently high risks include whether the business can be purchased through a virtual asset, whether cash is connected as a common aspect linked to the product or service, whether it is high value or low value and high volume distribution and the level of opaque ownership linked to the product of service.

What Are Types Of AML Geography Risks?

Geography Risks for Anti-Money Laundering Compliance and Financing of Terrorism are broad. Primarily the risks are linked to exposures to matters linked to the strength of the rule of law operating within the country, the level of corruption, whether the country is subject to sanctions or is a country known to harbour (support) terrorism.

Other factors include the extent of organised crime and other predicate offences such as extent of illegal narcotics from manufacturing, distribution or consumption.