AML Transaction Monitoring

AML Transaction Monitoring for Anti-Money Laundering Compliance

AML360™ provides AML transaction monitoring services. The solution is fast to implement and importantly, it is affordable to small sized business entities. Don’t leave AML/CFT compliance on the back-burner. Take confidence that your firm is meeting AML/CFT compliance obligations.

Data At Your Fingertips

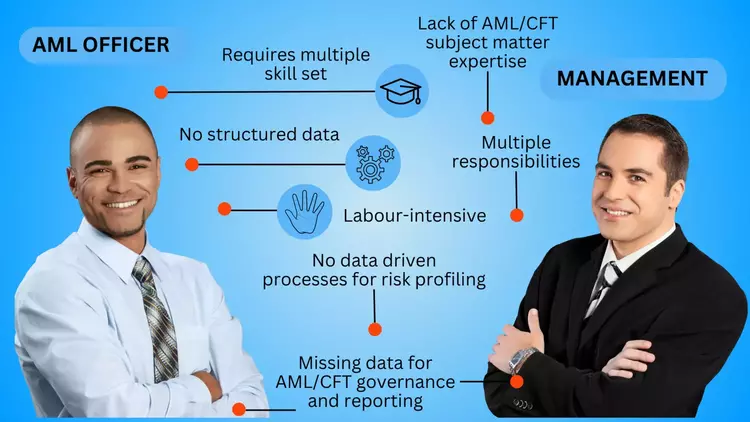

Three Common Problems with Anti-Money Laundering Compliance Programmes

#1 Problem: Small and medium sized businesses often lack internal human resourcing in subject matter expertise for AML/CFT compliance, risk management and data analysis.

#2 Problem: Additionally many small businesses cannot afford to develop their own technology or hire a full-time and qualified AML/CFT compliance professional

#3 Problem: Not having subject matter expertise and/or digital solutions results in high costs due to labour-intensive processes which causes AML/CFT compliance costs to exceed budget restraints.

Are Your Struggling With AML Transaction Monitoring?

Anti-Money Laundering Compliance obligations include client risk ratings and ongoing monitoring of client activity. Though these obligations may seem complex, AML360™ ensures your firm can meet AML/CFT compliance without hassle, without fuss and without high-cost.

Easily Govern With Your Corporate Data

AML360™ easily transforms your business from high-cost labour-intensive systems into fast and efficient digital solutions. The technology solution is configured by AML/CFT compliance professionals and can be tested for compliance efficiency by your firm’s AML/CFT Compliance Officer.

By transferring to digital solutions your firm gains confidence that AML/CFT compliance can be demonstrated for efficiency.

AML360™ easily integrates with all bank accounts, Xero and other banking records.

By Relying On Digital Solutions Compliance Costs Are Significantly Reduced

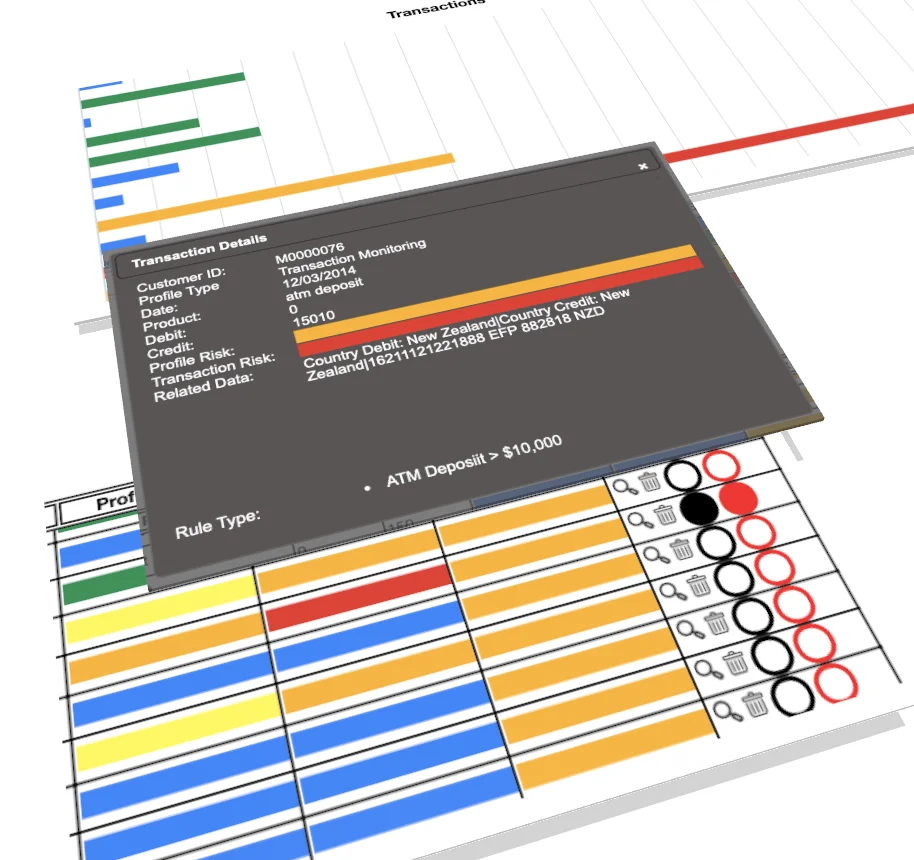

Anti-Money Laundering Compliance has many administrative and repetitive tasks that cannot be avoided but can be streamlined with AML360™.

Effortlessly meet AML/CFT compliance obligations of risk profiling, risk ratings and ongoing monitoring and reporting.

Avoid the regulatory radar by establishing your AML Transaction Monitoring framework with a proven AML/CFT compliance solution.

Your AML/CFT Auditor can independently test for adequacy. Should any recommendations follow for strengthening, updates are instant.

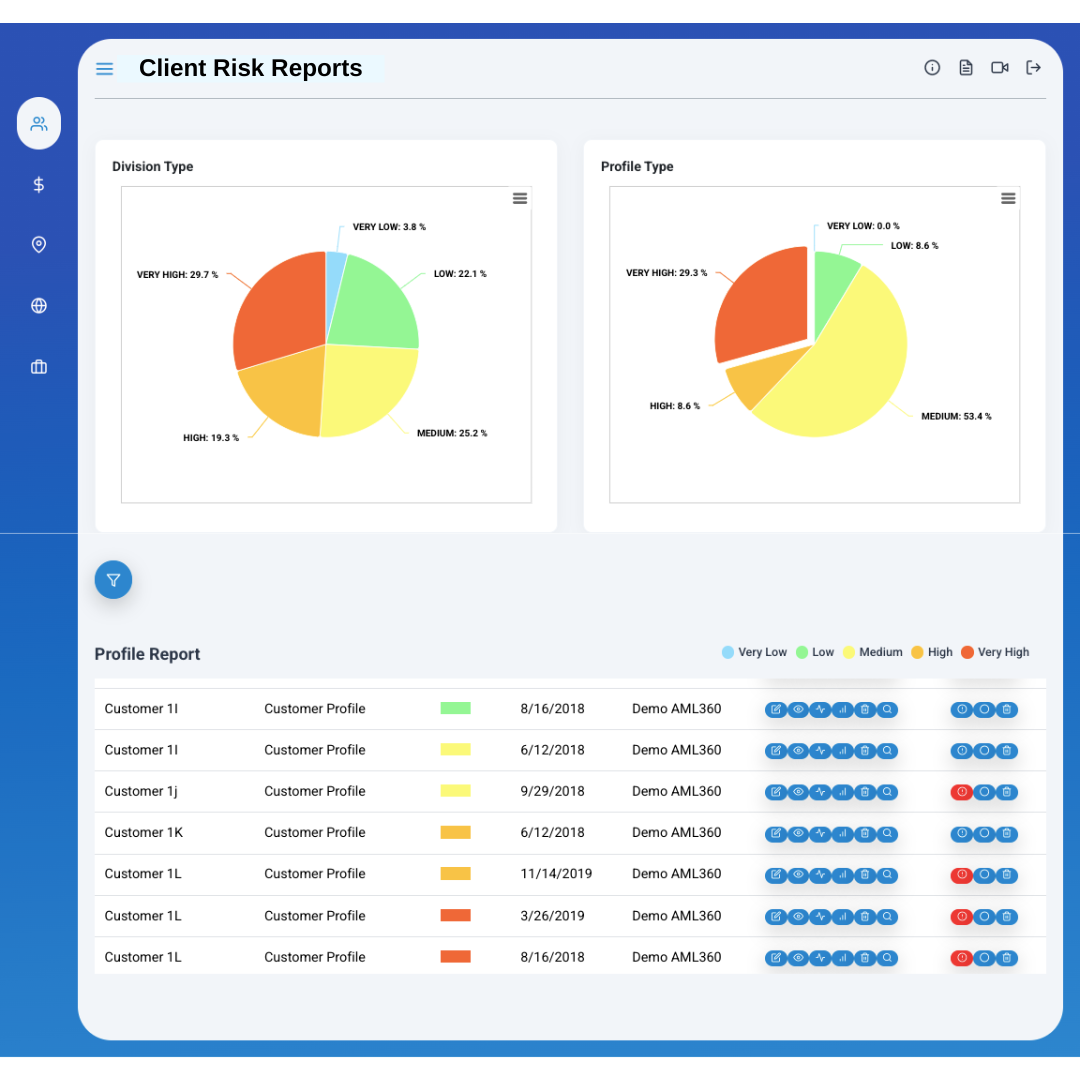

AML Transaction Monitoring and Ongoing Reporting

AML Transaction Monitoring needs to incorporate aspects of the firm-wide business risk. This includes results of customer risks and products/services risks.

By having individual client risk ratings and understanding the product and services risk, your business is better equipped to meet AML/CFT compliance obligations.

When AML/CFT regulations change or AML/CFT Supervisor expectation increases, your business can instantly configure the rules or thresholds without additional costs.

It is not just AML/CFT Compliance Officers who must understand ongoing risks. Senior Managers and Board Members must also be able to demonstrate a certain level of AML/CFT compliance governance and oversight.

An effective reporting methodology for Board members and managers is the use of AML/CFT compliance heat maps.

AML Compliance Heat Maps can quickly transfer knowledge at a high level. AML360™ compliance modules can be supported with data reports to further describe heat maps to managers who need more detail.