Automated Work Flows

How to Develop a Customer Risk Rating Model

An AML/CFT Customer Risk Rating model assists a business to manage, monitor and report on exposures that increase the likelihood of the business facilitating money laundering and/or financing of terrorism. When developing an AML/CFT customer risk framework, your business must demonstrate the model reasonably informs on AML/CFT compliance risks.

Risk-Based Reporting

Risk configurations are set to the nature, size and complexity of your customer base.

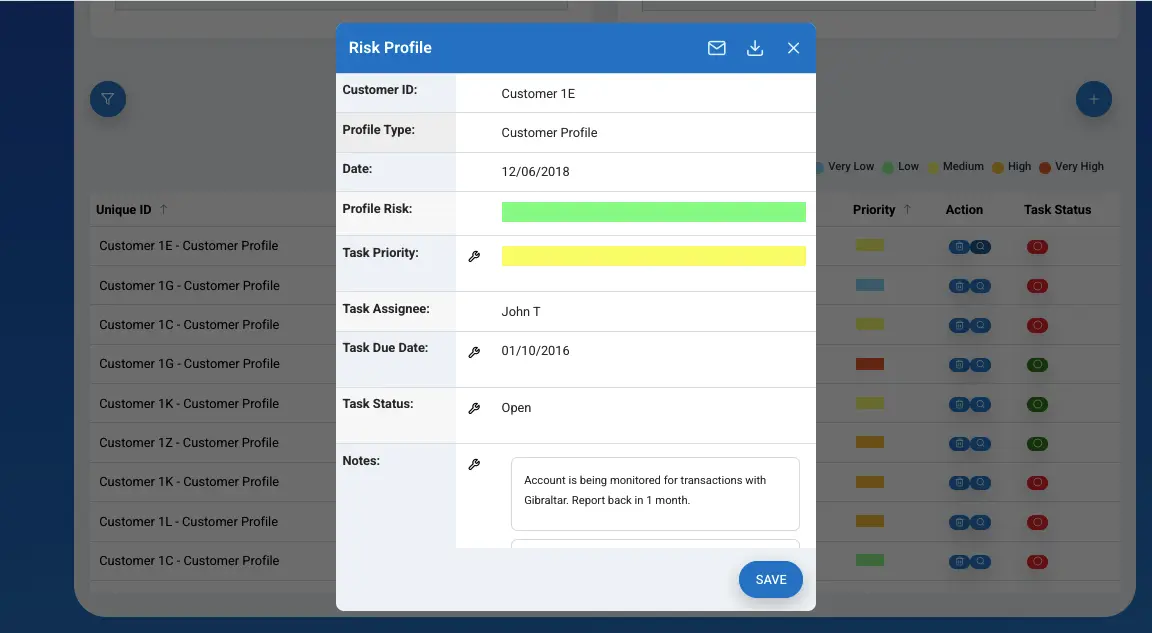

Customer Risk Rating

A risk rating is provided, including heat maps of underlying risk drivers.

Customer Risk Report

A client risk rating report is provided to demonstrate regulatory expectation.

Governance Controls

Don’t allow AML client risk rating obligations to cause a compliance breach.

Is Your Firm Compliant with AML/CFT Customer Risk Rating and Reporting?

Commencing from 1 June 2025, New Zealand’s Anti-Money Laundering and Countering Financing of Terrorism Act (AML/CFT Act), introduces Regulation 12AC.

From 1 June 2025, all New Zealand businesses that are captured under the AML/CFT Act, must ensure they have a customer risk rating procedure in place.

Though Regulation 12AC emphasises the requirement for a customer risk assessment, businesses should already have existing systems in place foe measuring client risks under Section 22(1)(d).

Section 22(1)(d) of the AML/CFT Act requires businesses to identity higher risk customers and apply Enhanced Due Diligence.

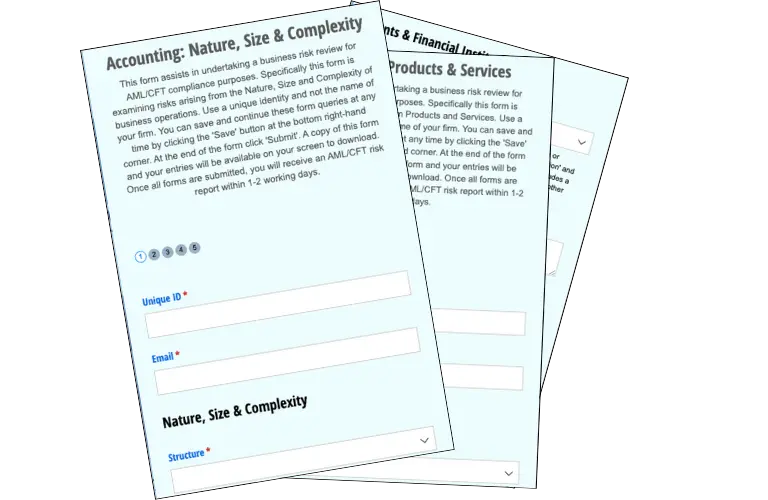

Utilise Existing Data and Expand Data Capture if Necessary

It would be unlikely that a business has no existing relevant data that it can utilise for developing AML/CFT customer risk ratings.

Common data that can be utilised includes (a) country of residence, (b) country of activity reach, (c) employment or industry sector, (d) expected volume of activity, (e) expected value of activity, (f) nature and purpose of business relationship, (g) risk perception rating.

Why Are Customer Risk Ratings Important?

A customer presents the highest risk to a business unwittingly facilitating money laundering (ML) and/or financing of terrorism (FT).

If the customer has no interest in using their business relationship to facilitate ML/FT, then it is clear ML/FT risks are significantly reduced.

Understanding the Nature and Purpose of the customer’s relationship with your business provides informed knowledge of expected customer activity.

When the Nature and Purpose of the customer relationship is understood, unusual or suspicious activity is easier to detect.

Therefore, not applying a customer risk rating weakens the ongoing monitoring framework of an AML/CFT Programme.

Senior managers and Board members should receive some level of reporting on the business entity’s underlying client base and ML/FT risk exposure.

AML360™ heat maps are a simple and effective method to inform at high levels. Heat maps should always be supported with a data report that explains the risk.

AML360™ provides Client Risk-Based Reporting for AML/CFT Compliance Officers, senior managers, Board members, auditors and AML/CFT Supervisors.

Ongoing Monitoring and Reporting of AML Client Risks

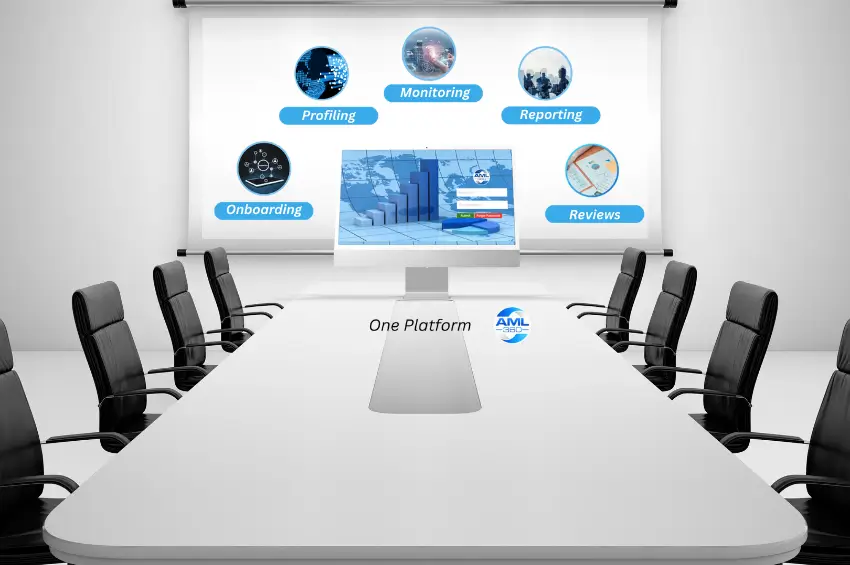

Anti-Money Laundering Compliance has a lot of administrative tasks, which are repetitive.

AML360™ eliminates labour intensive processes and introduces streamlined reporting.

Our technology solutions are easy to implement with a single click.

If your business is struggling with costs of AML/CFT compliance or lacking internal expertise, AML360™ provides an all-in-one solution.

AML Customer Risk Rating

Governance Reporting: AML Customer Risk Rating Models

Your AML/CFT Customer Risk model must reasonable inform on the likelihood of the customer being involved in a financial crime. AML360™ provides your business with a service that tailors a customer risk model to the size, nature and complexity of your business.

Structured Customer Risk Rating & Reporting

- Regulatory Efficiency

- Informed Reporting

- Products | Transactions

- Heat Maps

- Easy Updates

We use AML/CFT compliance expertise to deliver you a reliable risk-based methodology for AML/CFT customer risk reports.