Anti-Money Laundering Compliance

Easily Implement AML/CFT Client Risk Rating Software

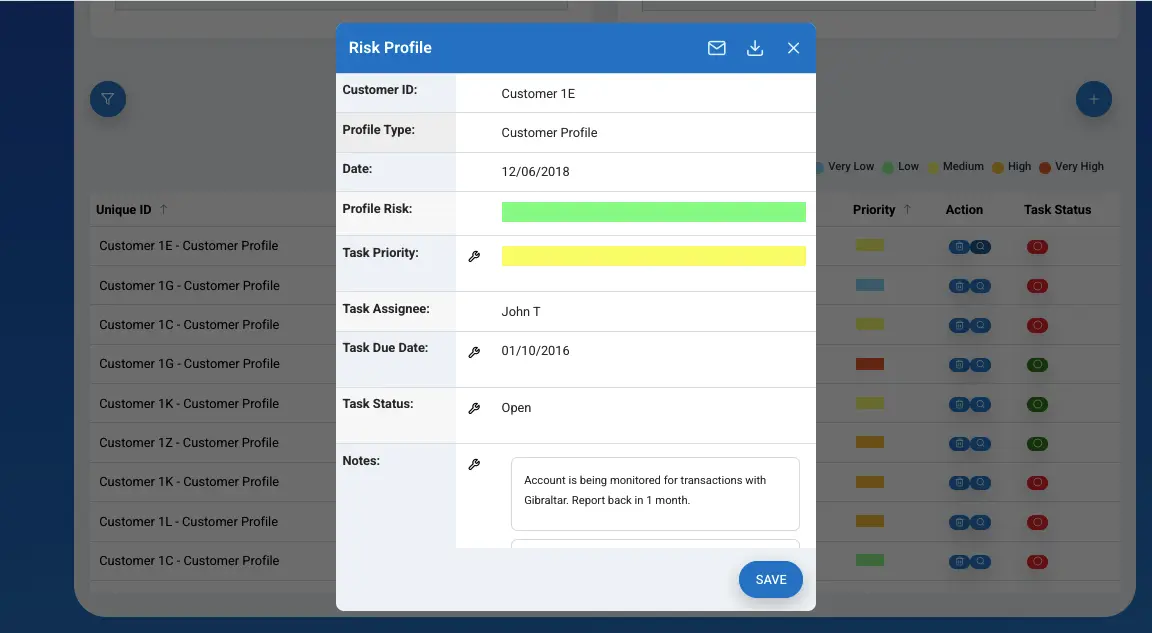

We provide client risk rating software for all sized business entities. Options include customised links to activate a Client Risk Rating Report. These links can embed into AML/CFT Programmes and represent processes and procedures. For businesses that want greater sophistication with interactive analysis, Cloud customer risk register is available.

Don’t sweat complexities of AML/CFT Compliance. Gain efficiency, reduce costs and streamline processes with AML360™ Regulatory Technology.

Establish a client risk reporting framework that stands up to independent scrutiny.

Readily access customer risk rating reports and embed AML/CFT procedures.

Gain compliance efficiency whilst reducing. operational compliance costs.

AML Client Risk Rating Software

From 1 June 2025, changes are happening for businesses that are captured under New Zealand’s compliance laws known as Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT). By this date the business must have established and implemented an AML customer risk rating system that adequately risk scores and reports on the client’s exposures to facilitating money laundering and/or financing of terrorism.

What Is AML Client Risk Rating Software?

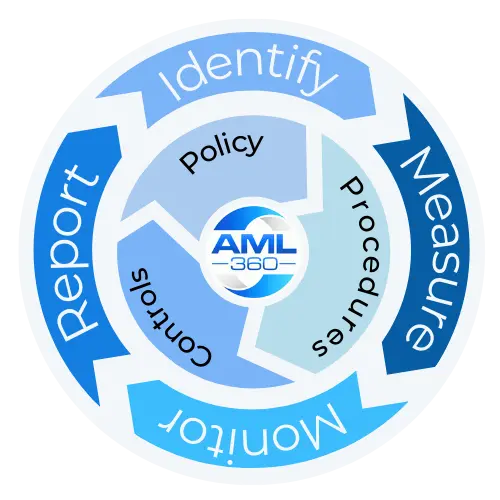

Businesses must be informed of client risk exposure to Money Laundering (ML) and/or Financing of Terrorism (FT). Additional to the need to have Client Risk Ratings, obligations include carrying out Enhanced Due Diligence on higher risk customers. This relates to obligations of Section 22(1)(d) of the AML/CFT Act.

Your Customer Risk Rating Software can include simple and affordable solutions that achieve compliance efficiency. If your business requires a sophisticated reporting and analysis Cloud service, AMLl360™ can provide that too.

Customer Risk Rating Software to Trigger Enhanced Due Diligence

To achieve AML customer risk rating and scoring, a business will need to start with examining the type of data that exists relevant across all customers and/or the majority of customers.

The data will then need to be examined for relevance to ML/FT risks. This may include information of the country or countries linked to the client either by being domiciled or reach of business activity.

The expected volume of the customer activity and the expected value of the customer activity is also relevant to segregating risks levels.

The types of products or services that the customer accesses should be included in the AML customer risk rating, including the method of interaction with the client.

Where some customers have data gaps, an automatic default of high should be applied to that data gap. Once the ‘missing’ information is gathered, the client’s profile can be updated for the AML customer risk rating model.

Experience AML Client Risk Rating Software. Avoid the risk of a regulatory fine and govern your AML customer risk rating model with AML360™.

Get confident by using Customer Risk Rating Software and achieve ongoing oversight of AML/CFT client risks.

How Can AML360™ Assist?

Not only can we assist in the development of an AML customer risk rating and scoring methodology, but we can also provide your business with a streamlined reporting service.

Avoid the risk of a regulatory fine and govern your AML customer risk rating model with AML360™.

Get confident by using services that have ongoing oversight of AML/CFT compliance professionals.