AML Outsourcing Services

Experience AML Outsourcing with Regulatory Technology

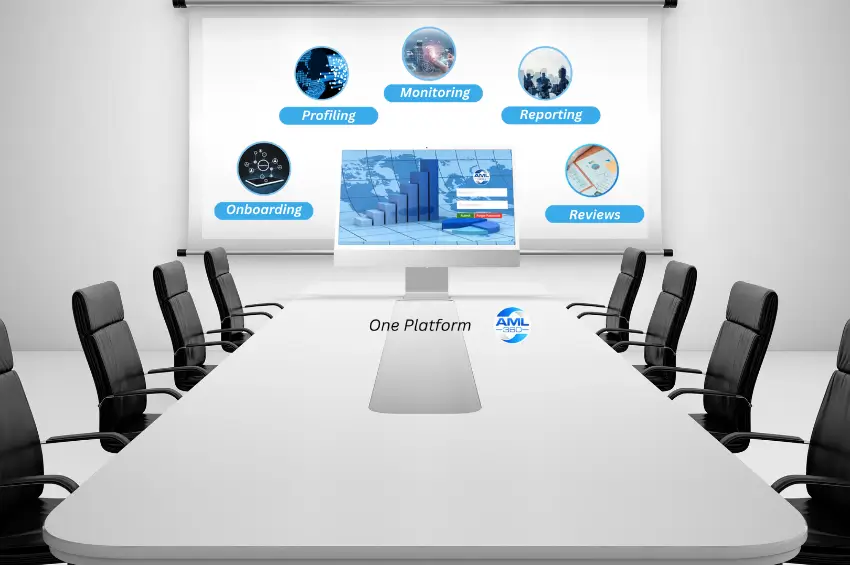

AML Outsourcing with AML360™ Regulatory Technology is configured by Anti-Money Laundering Compliance Professionals. The AML/CFT compliance platform automates complex compliance processes. AML360™ delivers to your business AML/CFT structured reporting to align with risk-based regulatory expectation.

Select the services you require and we deliver your digital reporting platform, customised to the nature, size and complexity of your organisation.

Your Anti-Money Laundering Compliance Officer is alerted for action points that meet your policy requirements. Alerts are sent to your AML/CFT register and tracked.

Governance, Risk and Compliance Reporting is delivered at a frequency that meets requirements of your AML/CFT Programme. This is indepth reporting.

AML Outsourcing with AML360™ streamlines AML/CFT compliance

As regulatory technology for anti-money laundering compliance, your AML Officer only needs to select filters on the screen and click the ‘Submit’ button. AML360™ AML/CFT compliance technology is delivered with knowledge-based reporting. AML360™ risk compliance reports include advisory services. Configurations are customised to AML/CFT regulatory expectations. Cut back AML/CFT compliance costs with Do-It-Yourself AML/CFT regulatory technology.

We generate business critical reports such as business risk assessments, client risk profiling, internal reviews and management reporting.

We send prompts and alerts to notify your AML/CFT Compliance Officer of a matter requires closer attention. We track and support action points.

AML360™ Outsourcing offers a global service model. We provide your business with access to regulatory technology and AML/CFT compliance professionals.

AML360™ ensures AML/CFT governance and best practice is at the forefront of AML/CFT policies, procedures and controls with continuous monitoring.

AML Advisory & Audits

Reduce Costs with AML360™ Technology

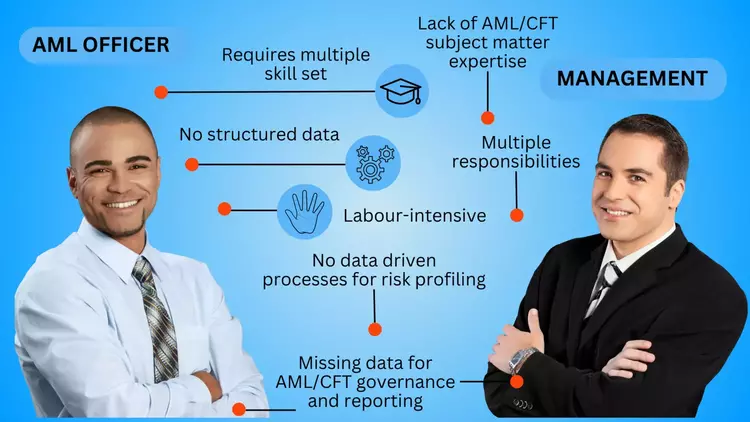

If your firm is experiencing high-cost for servicing AML/CFT compliance, you are likely heavily reliant on manual processes.

If AML/CFT compliance is serviced through use of labour-intensive processes, the human resourcing cost will result in high costs for AML/CFT compliance. A solution to reducing costs and improving compliance efficiency, is the use of AML/CFT regulatory technology.

AML360™ is configured to automate risk measurement, monitoring and reporting.