Risk-Based Approach

AML Risk Assessments

AML360™ provides your firm with a simplified but effective method for completing AML Risk Assessments and Client Risk Profiling. Examine your business risk exposures to unwittingly facilitating money laundering or financing of terrorism and meet regulatory objectives.

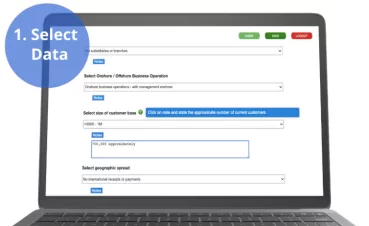

We provide you an online form with the required regulatory data points so your business can adequately assess your AML/CFT business risks.

AML Risk Assessment Data

AML360™ technology identifies your higher risk areas with simplicity.

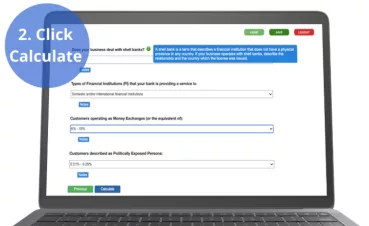

Add Notes & Click To Submit

Work through the form, add notes then submit for structured reporting.

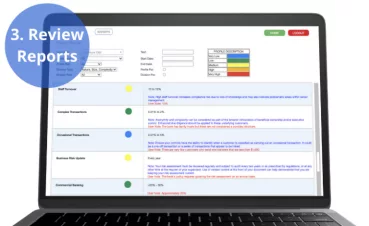

AML Risk Assessment Report

Your report explains the risks, measures exposure levels and includes policy prompts.

Simplify your compliance processes with an AML360™ AML Business Risk Assessment

Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT). Don’t second guess your risk factors. Use a proven compliance solution and gain oversight from an AML/CFT compliance specialist.

AML Risk Report

AML Risk Assessments with RegTech

Compliance laws for Anti-Money Laundering & Countering Financing of Terrorism require an effective firm-wide risk report. Not all businesses however have an in-house AML/CFT compliance professional. Or a business may lack expertise in how to document an effective risk methodology. Penalties are high for an inadequate risk assessment and the ongoing regulatory scope upon your business is disruptive.

The AML360™ risk assessment has been developed by compliance professionals for Anti-Money Laundering Compliance Officers and Money Laundering Reporting Officers.

AML360 Regulatory Technology allows your business to access AML Compliance expertise without incurring additional advisory costs. Just open and complete the form, submit, and receive your customised AML/CFT business risk report.

Results include an AML/CFT Risk Assessment Guideline to explain the AML/CFT risk methodology.

AML Risk Assessments Deliver Informed Decision Making

Governance Reporting: AML Risk Assessments

AML Risk Assessments should be reviewed and updated at least every year. The review should consider AML/CFT Supervisor guidance material and reflect any changes that have occurred within the business sector or national risks. By using the AML360™ form, your business will automatically incorporate structured data to AML/CFT risk reporting.

Structured Reporting of AML Risk Assessments

- Nature, size & Complexity

- Clients | Institutions

- Products | Transactions

- Method of Delivery

- Countries Dealt With

We use AML/CFT compliance expertise to deliver you a reliable risk-based methodology for AML/CFT business risk assessments.