Anti-Money Laundering Compliance | How To Excel In AML/CFT

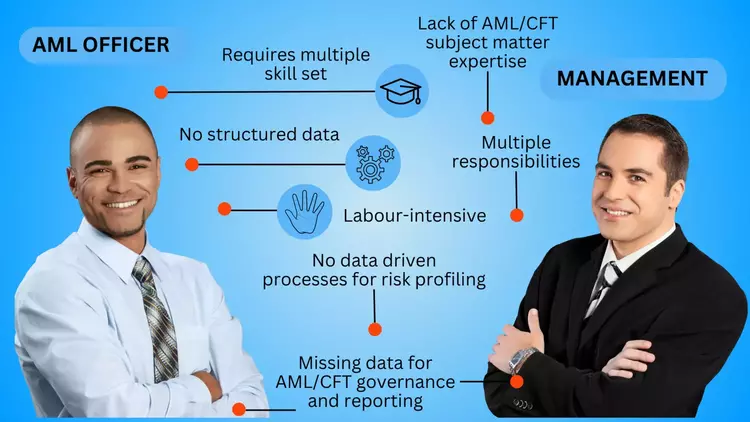

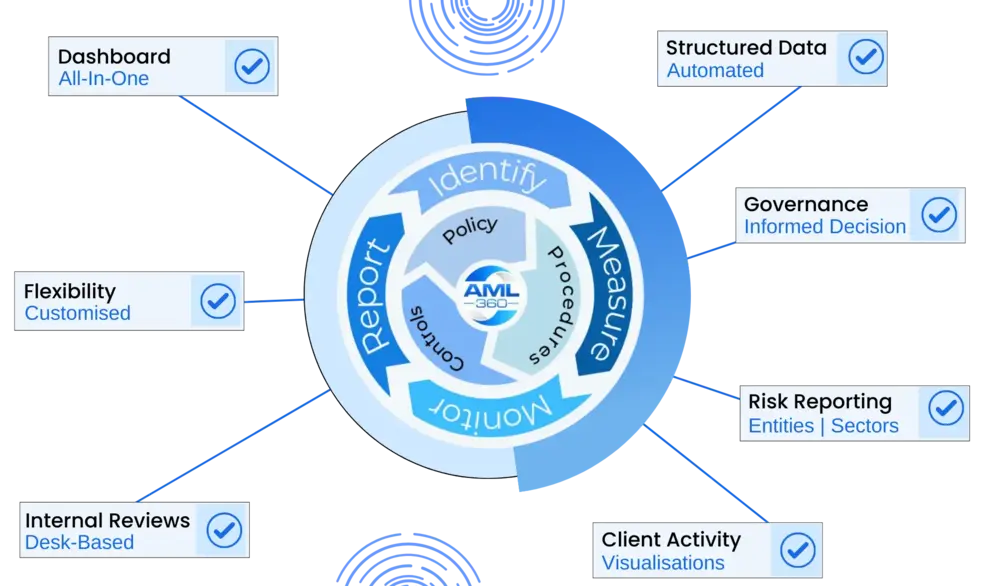

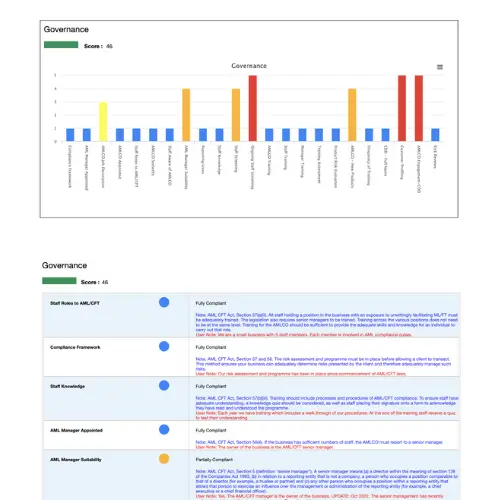

Anti-Money Laundering Compliance and How To Avoid An AML/CFT Compliance Breach To meet regulatory expectation of risk-based anti-money laundering compliance laws, businesses should be utilising AML/CFT solutions for automating risk-based customer reporting and ongoing monitoring solutions. Without such compliance tools, an AML/CFT Programme is likely to be failing to meet regulatory expectation whilst also experiencing […]