AML Client Risk Profiling | How To Excel In AML Compliance

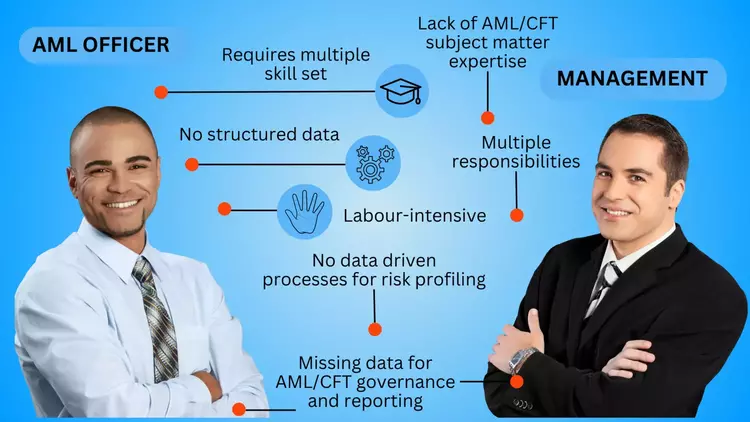

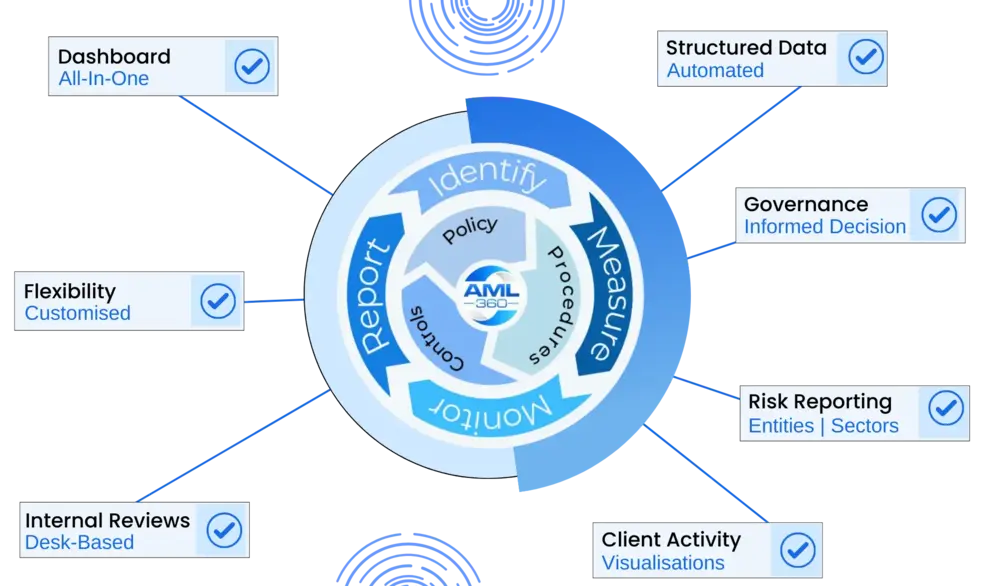

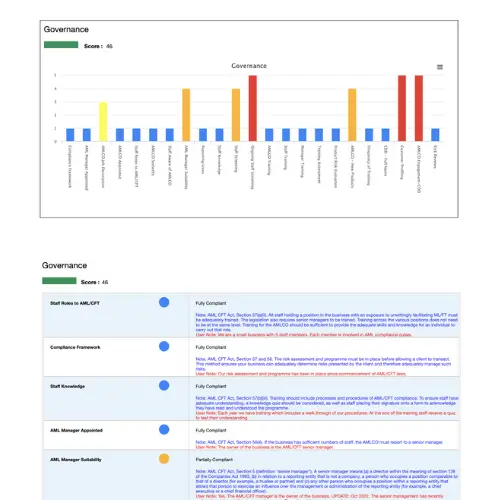

Client Risk Profiling AML/CFT A Solution for Anti-Money Laundering Client Risk Profiling Client Risk Profiling is essential for anti-money laundering compliance frameworks. Knowing the risk of customers or clients is often referred to as Know Your Customer or Know Your Client. The client risk rating for AML/CFT supports obligations of ongoing monitoring and reporting. Brochure […]