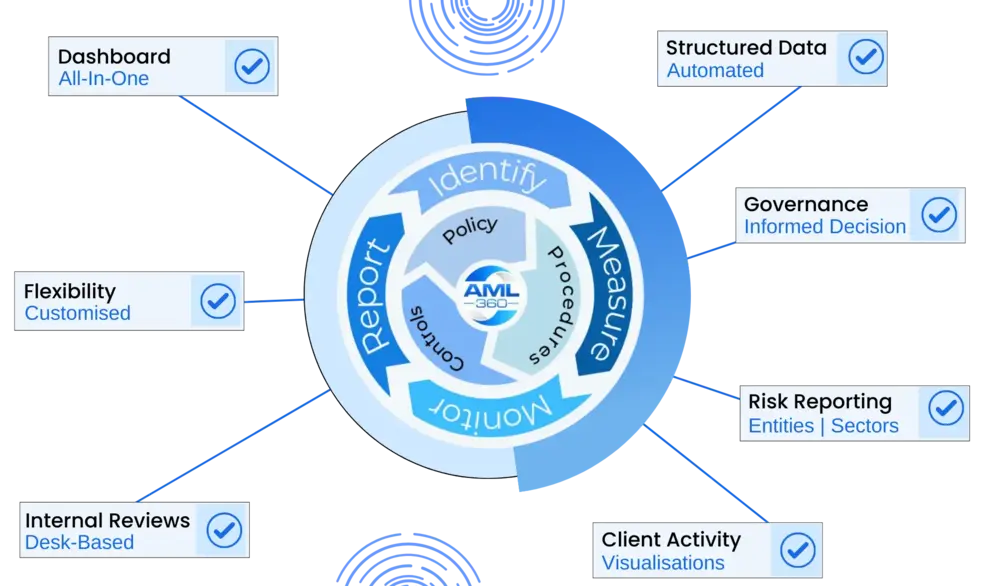

Boost Compliance with AML Software Now

Looking for Risk-Management AML Software? Experience AML360™ AML Software for Anti-Money Laundering Compliance AML Software Solutions AML360™ AML Software, assists businesses to establish and maintain automated workflows. With the click of a keypad, the anti-money laundering compliance software measures risks and provides structured compliance reporting. AML360™ is an all-in-one compliance solution for managing anti-money laundering […]