Know Your Customer Risks

Client Risk Profiling

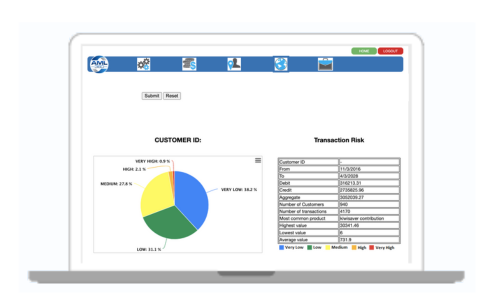

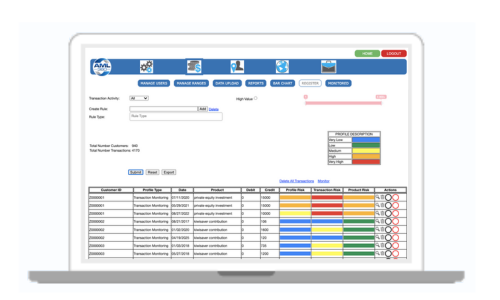

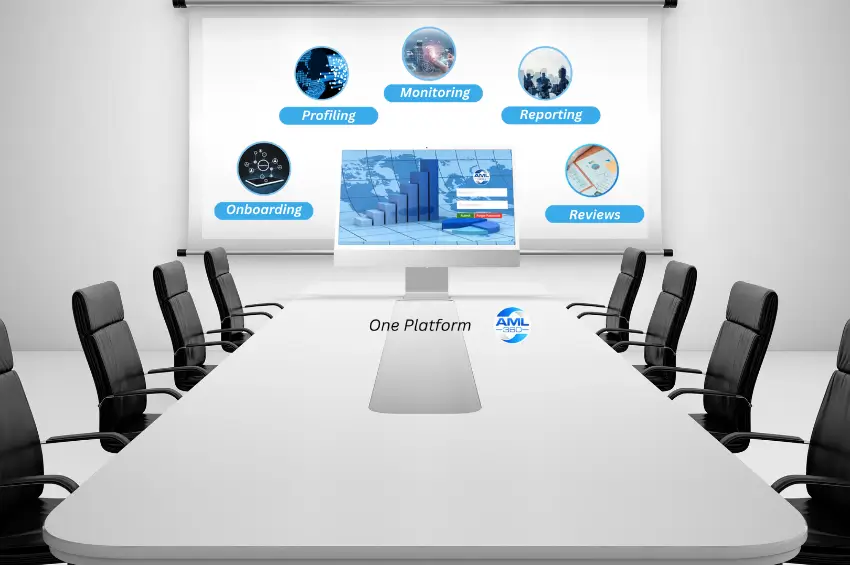

Customer Due Diligence is simplified with the AML360™ Dashboard. Incorporate client profiling with drill-down filters, heat maps of key risks, as well as client profile reports. You can quickly identify the risk status across your client base through a single mouse click. The software is fully tailored to meet your AML/CFT compliance requirements.

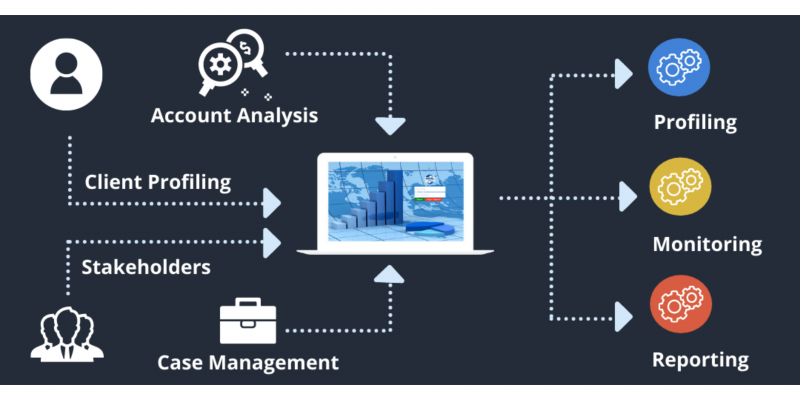

AML360™ Compliance Dashboard

Developed on the principles of risk-based compliance technology, the AML360™ Dashboard automates the process of risk management protocols. AML360™ Regulatory Technology is configured to simultaneously collect data, measure, monitor and report. By using automation and risk-based principles of AML/CFT compliance obligations, AML360™ significantly improves AML/CFT compliance and reduces ongoing compliance costs.

Clients present the greatest risk to your business unwittingly facilitating money laundering or terrorism financing. We establish your profiling methodology and test for adequacy.

Your AML Supervisor expects greater resourcing commitment to higher risk customers. We make that easy to achieve.

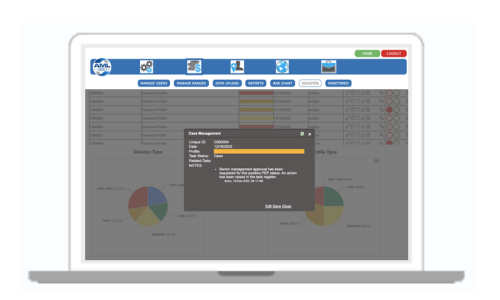

The Unique ID option fully protects client data. This ensures no accidental privacy breach and retains business confidentiality.

AML360™ ensures governance, risk and compliance can be demonstrated against regulatory risk-based AML/CFT laws.