AML Client Risk Model

How To Maintain An AML Client Risk Model

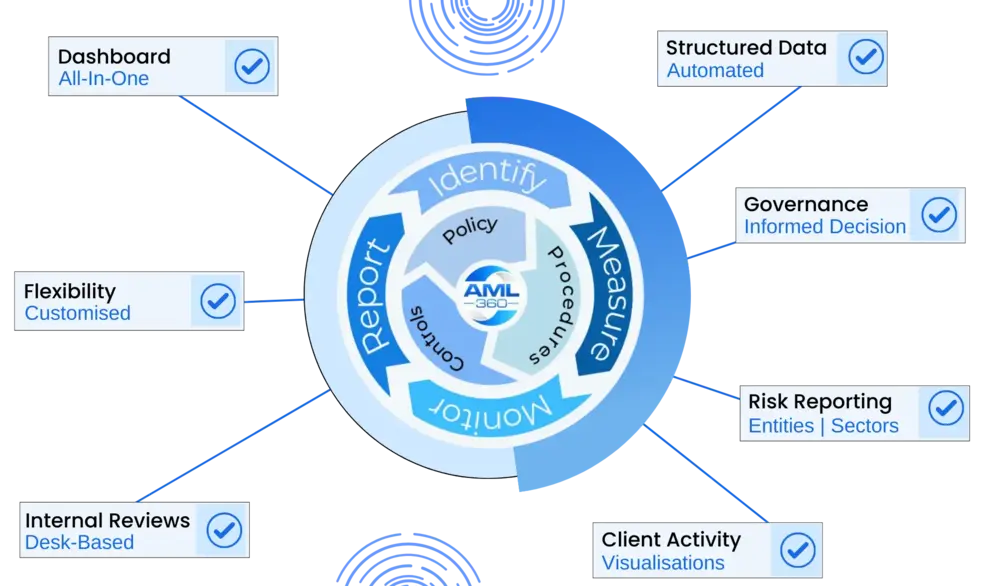

If your business is captured under Anti-Money Laundering Compliance laws, you must implement an AML Client Risk Model. An AML/CFT Client Risk Model will set the evaluation processes and practices for determining client risks in facilitating money laundering and/or financing of terrorism. The anti-money laundering Client Risk Model supports AML/CFT ongoing monitoring obligations of the AML/CFT Programme.

Data At Your Fingertips

AML Client Risk Model For Onboarding

We develop your branded client onboarding form with required regulatory data.

Easily Review and Modify the Client Risk Rating

The structured onboarding form includes minimum data requirements for risk profiling

Ongoing Monitoring & Reporting

Easily administer AML/CFT compliance risk reporting and meet regulatory obligations.

AML360™ provides not only client risk modelling but every aspect of risk-based compliance reporting. We ensure configurations are adequate and tested for AML/CFT compliance effectiveness. Remove complexities and labour intensive processes with AML360™. Reduce costs and gain compliance efficiency with automated risk-based compliance reporting.

Get quality assurance and protect brand value with an Independent AML/CFT Audit