How To Streamline AML Client Risk Ratings

AML Client Risk Ratings should start at the onboarding stage and continue throughout the lifecycle of the business client relationship. AML360™ establishes your client risk profiling and rating methodology. Seamlessly integrate with existing client onboarding. Easily produce and access AML client risk reports to demonstrate governance for AML/CFT compliance.

Client Onboarding

We develop your branded client onboarding form with required regulatory data.

Client Risk Rating

The structured onboarding form includes minimum data requirements for risk profiling

Monitoring

Easily administer AML/CFT compliance risk reporting and meet regulatory obligations.

AML Client Risk Ratings

A Solution for AML Client Risk Ratings

If your business is struggling with the ‘How To’ of AML Client Risk Ratings, we will take care of your risk profiling methodology and client risk reportings. Whether you have several clients, hundreds, thousands or tens of thousands, AML360™ delivers a customised client risk profiling methodology that is streamlined for instant reporting.

Data At Your Fingertips

We Can Develop and Test Your AML Risk Ratings

Demonstrate compliance with regulations for implementing Client Risk Assessments. Our AML/CFT compliance professionals assist you to develop a client risk rating model. We provide your firm with an AML/CFT compliance report for inclusion to your AML/CFT Programme.

AML Risk Risk Ratings and Reporting Requirements

From 1 June 2025, changes are happening for businesses that are captured under New Zealand’s compliance laws known as Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT). By this date the business must have established and implemented an AML client risk rating system for new clients that adequately risk scores and reports on the client’s exposures to facilitating money laundering and/or financing of terrorism.

For existing customers, a client risk rating system should be incorporated into ongoing monitoring.

New Zealand’s AML/CFT Supervisors are expecting businesses to demonstrate risk-based decision making when applying AML/CFT compliance customer risk ratings.

What Are AML Client Risk Ratings and Why Do They Matter?

New Zealand’s Anti-Money Laundering compliance laws are referred to risk-based legislation or law that applies risk-based principles. This means decision making arising for AML/CFT compliance needs to be based on informed knowledge and be relevant to the risk exposure.

By establishing systems for risk-based reporting, a business is better equipped in implementing an AML/CFT compliance programme to manage the risk level presented. However money laundering and terrorism financing risks are not stagnant. Systems in place for risk profiling, monitoring and reporting therefore need to be flexible and be able to modify and align as underlying risk parameters or thresholds change.

The AML customer risk rating or AML customer risk score will therefore assist the business to make decisions on resourcing commitments to manage the customer risk.

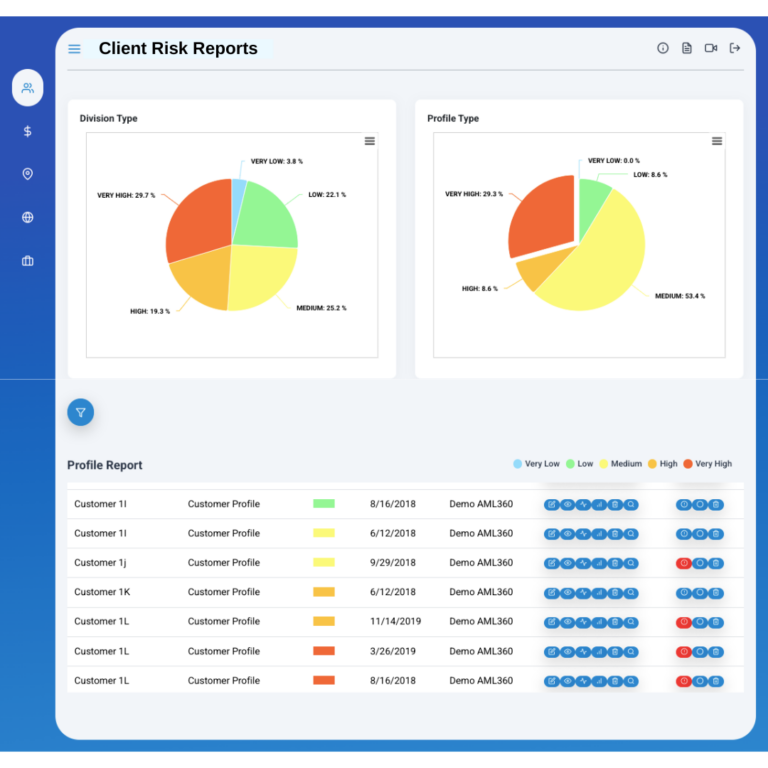

The customer risk report will inform the business and the Anti-Money Laundering Compliance Officer on the frequency of reporting for client activity. The customer risk report will also inform on the reasons why the risk is low, medium or high.

In having informed knowledge of AML customer risk rating, the business is able to demonstrate compliance for application of enhanced due diligence. Section 22(1)(d) of the Anti-Money Laundering and Countering Financing of Terrorism Act (AML/CFT Act), requires enhanced due diligence on higher risk customers. If a business cannot demonstrate how they make decision making on higher risk customers, then they cannot demonstrate compliance with section 22(1)(d).

AML Risk Ratings And Enhanced Due Diligence

In having informed knowledge of the AML customer risk rating, the business is able to demonstrate compliance for application of enhanced due diligence.

Enhanced Due Diligence (EDD) is a requirement under AML/CFT laws. Section 22(1)(d) of New Zealand’s Anti-Money Laundering and Countering Financing of Terrorism Act (AML/CFT Act), requires enhanced due diligence on higher risk customers.

If a business cannot demonstrate how they make decision making on higher risk customers, then they cannot demonstrate compliance with section 22(1)(d).

To achieve AML customer risk rating and scoring, a business will need to start with examining the type of data that exists relevant across all customers and/or the majority of customers.

The data will then need to be examined for relevance to ML/FT risks. This may include information of the country or countries linked to the client either by being domiciled or reach of business activity.

The expected volume of the customer activity and the expected value of the customer activity is also relevant to segregating risks levels.

The types of products or services that the customer accesses should be included in the AML customer risk rating, including the method of interaction with the client.

Where some customers have data gaps, an automatic default of high should be applied to that data gap. Once the ‘missing’ information is gathered, the client’s profile can be updated for the AML customer risk rating model.

Senior managers and Board members should receive some level of reporting on the business entity’s risk exposure to customer risk under AML/CFT laws.

Heat maps are a simple and effective method to inform at high levels. Heat maps should always be supported with a data report that explains the risk. These reports should be readily available to AML/CFT Compliance Officers, senior managers, Board members, auditors and AML/CFT Supervisors.

How Can AML360™ Assist?

AML360™ provides your business with advisory services to develop a compliance framework for AML customer risk rating and reporting. Using regulatory technology we can test the risk methodology for adequacy and application of the AML/CFT risk-based principles.

We provide you a compliance report on the AML customer risk rating methodology as a supporting document to your AML/CFT Programme.

Not only can we assist in the development of an AML customer risk rating and scoring methodology, but we can also provide reporting services.

Our AML customer risk rating and reporting options can be through PDF, online compliance registers or both.

We ensure integration is quick and affordable.

Don’t leave the AML customer risk rating obligation on the back-burner. Avoid the risk of a regulatory fine and govern your AML customer risk rating model with AML360™.

Get confident by using services that have ongoing oversight of AML/CFT compliance professionals.