AML Case Management | How To Excel In AML Compliance

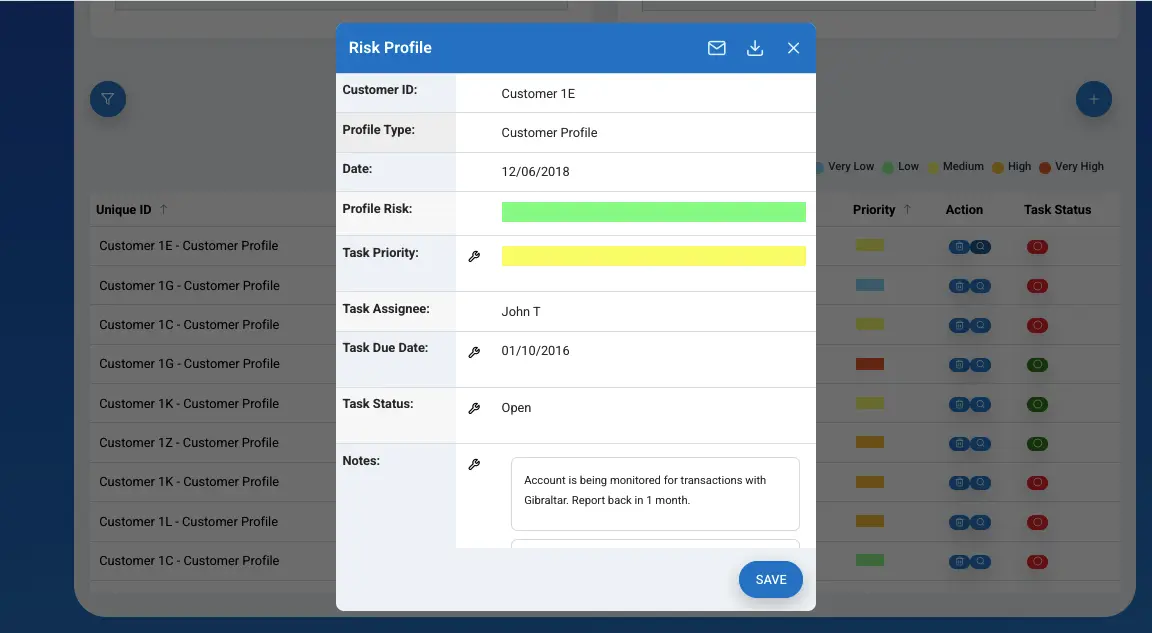

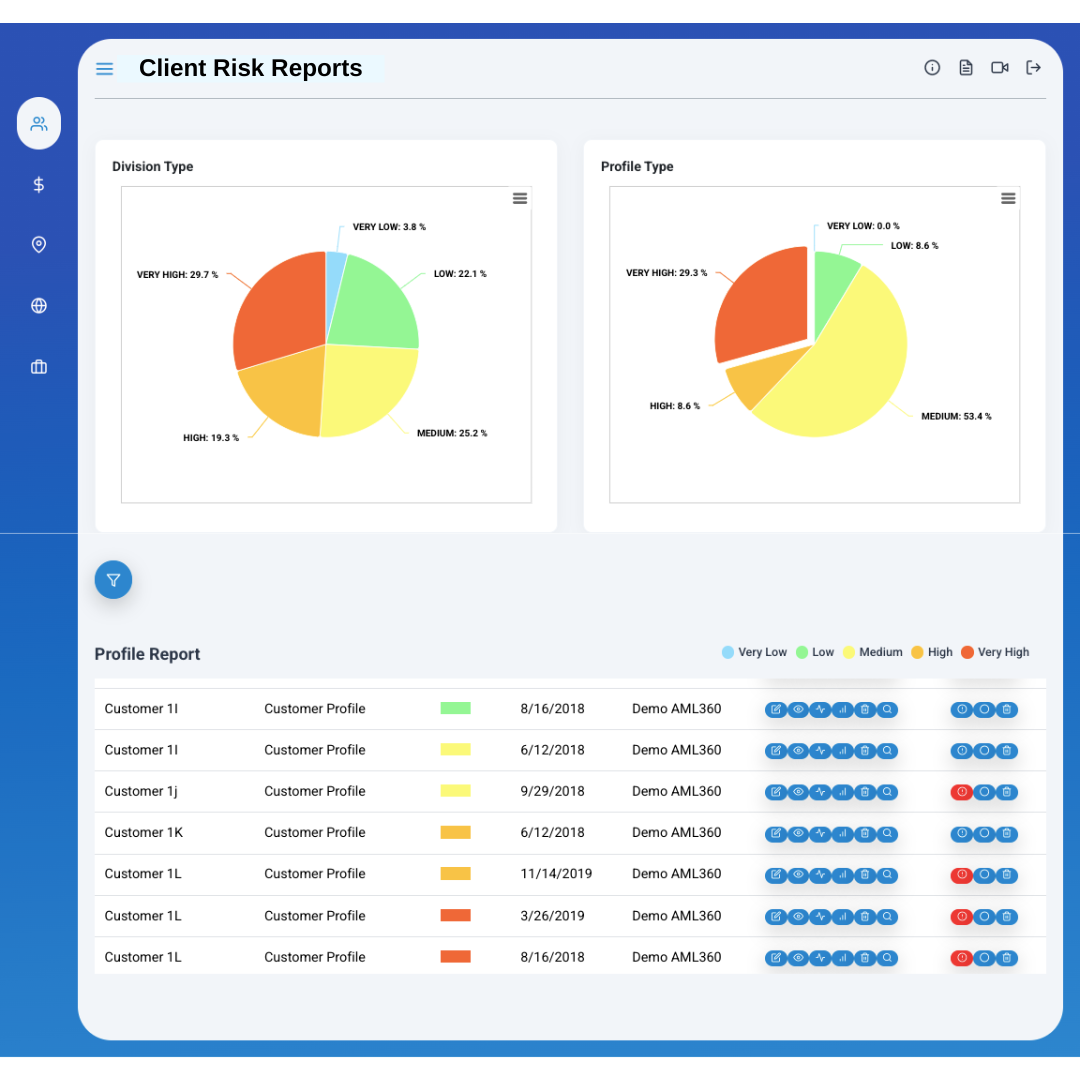

Track Compliance Activity AML Case Management AML Case Management: Your auditor and AML supervisor expect to see evidence of customer risk profiling and account activity monitoring. This requires a system capable of a work process flow and maintenance of record keeping. In doing so, independent third parties can understand the judgement and determinations made. The […]