Know Your Customer – Why is it important?

This article discusses anti-money laundering compliance obligations referred to as KNOW YOUR CUSTOMER (KYC).

Globally anti-money laundering compliance obligations are increasing as a result of countries working harder to meet the principles of the Financial Action Task Force (FATF). The FATF is the international watchdog. It sets out the principles on how governments and businesses can thwart financial crime and financing of terrorism. It expects individual jurisdictions to consider each principle and incorporate into their local legislation. To measure the effectiveness of a country’s efforts to detecting, managing and monitoring their financial sectors, the FATF carries out country inspections.

FATF was established in 1989 and though it cannot apply law enforcement action for a country’s breach of following their principles, it has significant power through ‘naming and shaming’ publications.

FATF has been instrumental in setting principles of risk profiling of not just AML risk assessments but also customer risk profiling.

What Benefits Does KYC Provide?

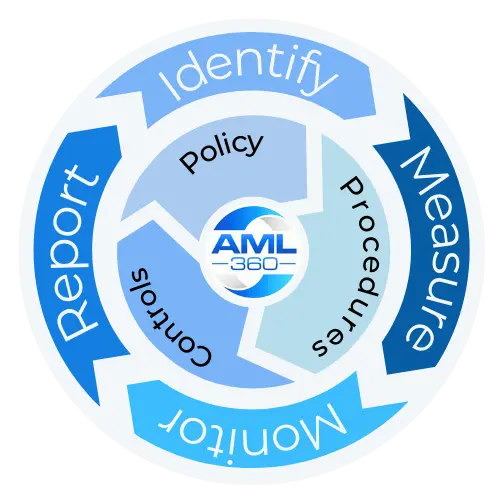

The overarching objective of anti-money laundering compliance is for businesses to detect and report any unusual or suspicious activity. It is therefore imperative for businesses to operate with adequate systems and controls so that when such an activity or transaction occurs, the businesses is alerted.

The starting point to identifying an unusual or suspicious activity from a customer is to first understand the risks the customer presents. A customer that is profiled as high risk is expected to have a greater level of resourcing dedicated to their activity.

The principles of Know Your Customer are to independently verify the customer is who they say they are and secondly, to understand the nature and purpose of the customer’s relationship with your business. When you understand the nature and purpose of the customer’s relationship, you are more likely to identify when a transaction, instruction or activity is unusual. If you are not able to do detect unusual activity against expected activity, you are not meeting compliance obligations.

How do you conduct customer risk profiling?

Customer Type

Your customer might be a private individual using their account for ordinary day-to-day living expenses. This would represent a lower risk customer, however you need additional data to confirm that the activity is not unusual or suspicious. A criminal may be wise and have an understanding of how risk profiling is carried out. They may state at time of account opening that they are operating their account for a purpose that draws no suspicion at all. This does not mean you do not need to monitor their account, rather you must monitor their account to ensure that the customer’s stated intention is matched by the of account activity being undertaken. Therefore if a customer states they are operating their account for ordinary day-to-day living expenses but you notice at the beginning of reach month there is a large cash deposit made, then your systems should be able to alert this to the AML compliance officer and secondly, have sufficient knowledge of KYC to make a determination if the matter requires a suspicious activity report.

Higher risk customer types include cash intensive businesses, businesses involved in export/importing, businesses trading in dangerous goods and businesses trading with multiple jurisdictions.

Know Your Customer’s Customer

If your client is a business then you not only need to gain an understanding of the nature and purpose of their business but also of the types of customers that they target. Do they target private individuals or businesses? Are they targeting specific jurisdictions and if so, are those jurisdictions considered higher risk? Does the business itself carry out identity verification, profiling and monitoring?

The more information you obtain at time of customer onboarding the greater the likelihood that you will be able to make a reliable determination during ongoing monitoring.

Volume and Value of Trade

If you know the expected number and value of transactions of your customer, you are in a better position to determine risk and to identify higher risk activity.

How can AML360 Help?

AML360’s compliance platform provides AML Compliance Officers with direct access to compliance modules. By completing a digital form, risk assessments of business operations and clients are reported back to your email address. There are also options of accessing results from a compliance register, incorporating case management and heat maps to simplify tracking and monitoring.

Because AML360’s are designed on automating data analysis, your business saves costs to the human resourcing factor.

To ensure affordability, our subscriptions can be paid on a monthly basis and cancelled at any time.